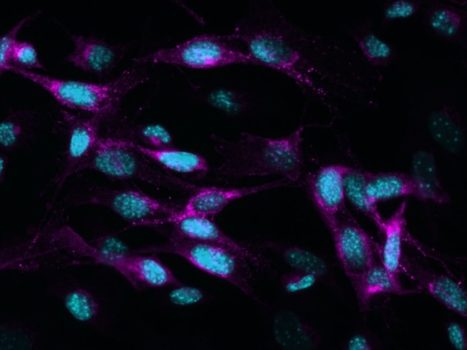

Where does this news come from? KCE report How to improve endometriosis care in Belgium? (1) presents a number of recommendations that were explained in Standard Dated April 4, 2024. The report states that endometriosis is a A very complex case It is, with too Variable impact on quality of…

Read More

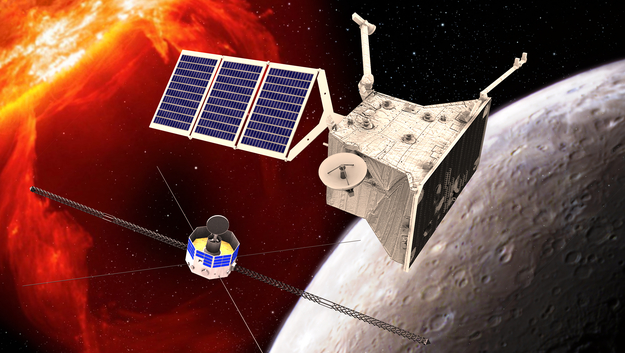

Venus loses carbon and oxygen ions

A brief visit by the European/Japanese BepiColombo space probe to Venus revealed gases being stripped from the planet's upper atmosphere. Discoveries in a previously unexplored part of Venus' magnetosphere show that carbon and oxygen ions are reaching speeds that allow them to escape the planet's gravity. (Nature astronomyApril 12). Unlike…

Read More

7 tips for flirting with self-confidence and success

What flirting does and doesn't work has been well-researched by psychologists for years. Here are 7 tips From psychologists To flirt with more confidence and success: Be clear, not precise Research shows that subtle flirtation attempts are often missed. So be more direct and clear in your flirting behavior. Use…

Read More

PROTECT YOUR SKIN: Sensually soft laundry without fabric softener, with this alternative!

Did you know that your clothes can look wonderfully soft and fresh without using fabric softener? Read on and discover alternatives to using a dose of fabric softener that will leave your laundry wonderfully soft. Use white vinegar An alternative to fabric softener is white vinegar. Vinegar neutralizes unpleasant odors,…

Read More

Exclusion of the “Animals and Transparency” organization from the elections: “Shame”

DierAnimal also cannot participate in elections. “It is a sad day for us,” says party leader Constance Adonis. “We did not get a signature from any retired Dutch-speaking MP. We could not reach 500 signatures. No list succeeded.” Bugs In the digital system According to her, there are several things…

Read More

Positive outlook on negative outcomes

Positive achievements and outcomes are emphasized, while negative outcomes often remain unrevealed. It is time to deal with failures differently, and not hide them behind closed laboratory doors. Failures teach us as much as successes. They provide insights into what's not working and why. As honest scientists, we should not…

Read More

Morocco with ten sports to Paris

The Summer Olympics will be held in Paris from July 26 to August 11. Morocco is represented in ten sports, both at the individual and team levels. Moroccan athletes have qualified for athletics, rowing, boxing, Break dance, CyclingFootball (U23), taekwondo, archery, equestrian sports and kayaking. Fatima Al-Zahraa participates in taekwondo,…

Read More

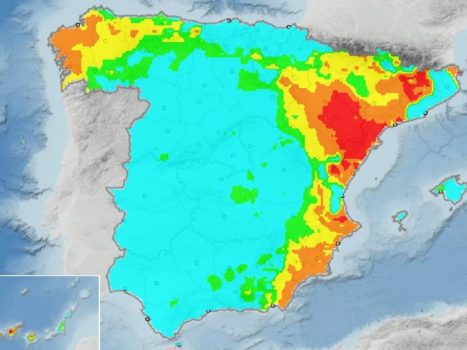

The Spanish Meteorological Service warned of the danger of forest fires in several areas

The Spanish Meteorological Service warned residents of the increasing risk of forest fires in several areas of the country. After several weeks of heavy rain, the weather in Spain has stabilized, with high atmospheric pressure and significantly higher temperatures for this time of year. These conditions greatly increase the risk…

Read More

Investing in a good organizational climate pays off

VIZKES/Shutterstock The vast majority of clinicians participating in the LAD Healthy and Safe Work project assess the organizational climate regarding psychosocial workload in their organization as inadequate. While an appropriate organizational climate is the basis for healthy and safe work. The LAD regulates the preconditions for a healthy and safe…

Read More

More than 3,000 participants at the Special Olympics National Games in Breda and Tilburg | Breda today

via: Haneke Marselis Wednesday, March 6, 2:00 p.m general Breda – With less than 100 days remaining until the start of the Special Olympics National Games, the cities of Breda and Tilburg are ready to welcome more than 3,000 athletes and coaches participating in 20 different sports. On Tuesday,…

Read More