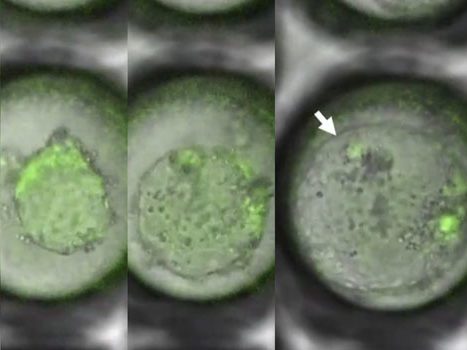

Artificial twin embryos have been developed from skin cells by a research team in Maastricht. They want to investigate the development of identical twins with a shared placenta, which increases the risk of pregnancy complications. There is currently no legislation for research with these explosives. Merlin Institute The study conducted…

Read More

Apple will hold a new event on May 7 focusing on the iPad

New iPad models with OLED display? Other surprises? The Apple Pencil is already an invitation staple. After the first event in 2024 with the launch of Vision Pro, the time will come again on May 7 with the launch of new products. The centerpiece of the invitation is the Apple…

Read More

Indian Prime Minister Modi accused of hate speech after statements in which he described Muslims as “invaders”

In a country of 1.4 billion people, about 80% consider themselves Hindu. About 14% of them are Muslim, but this is still a group of more than 200 million people. This makes India the third largest Muslim community in the world. India has long been known as a country where…

Read More

The more diverse nature is, the better for your mental health

“The richer the biodiversity, the longer the beneficial effect for people lasts,” the study published in the journal Nature concluded. Walking or exercising in an environment with many different plants, trees and views is good for the mind up to eight hours longer than a trip to less diverse nature.…

Read More

Meta's Ray-Ban smart glasses now work with Apple Music

Spring is here again, so you might be ready for new sunglasses. Have you ever thought about the Ray-Ban smart sunglasses released in collaboration with Meta? If you're someone who always wants to post everything on Instagram or Facebook, Meta's Ray-Ban smart sunglasses might be for you. And if you're…

Read More

Always win with Mario Kart? Science has a way

For many players, Mario Kart is not a very serious game. But what if you really want to win? Then there are some choices you have to make and science can help you with that. When playing Mario Kart with friends, most people will simply choose the character they like…

Read More

What are Europeans' favorite sports?

According to a survey conducted by Eurobarometer, 38% of Europeans exercise weekly, and 6% of respondents say they do so five times a week or more. While some sports are essential, others are specific to certain European countries. All of Europe invites you to see its preferences in sports. According…

Read More

The Rediscover Kanto event is live and will last over two weeks!

The Rediscover Kanto event has just launched in Pokémon GO. This event is part of the live launch of a new system called Pokémon GO Biomes, which we'll be sharing more information about shortly. Here are the initial details about the event: The Rediscover Kanto event runs from April 22…

Read More

Language generally becomes simpler

Charles Darwin found inspiration for his theory of evolution in the beaks of birds, giant tortoises, and language. “The survival or retention of certain words in the struggle for existence is natural selection,” he wrote. The descent of man In 1871. Language changes gradually over time. Much research examines how…

Read More

“Vodafone and Google join forces: Pixel spotted at the provider”

Google Pixel 8a is coming and it looks like the new Dutch provider will become a Google partner. You can now sign up to Vodafone to stay informed about the next Google smartphone. Read more after the announcement. “Vodafone will officially sell Google Pixels” There will be a new official…

Read More