WhatsApp is rolling out an update on iPhone that adds support for passkeys. This should be much easier and safer for users. Article continues after ad With passkey support, you can log in to apps using biometric data such as a face scan or fingerprint. The big advantage is that…

Read More

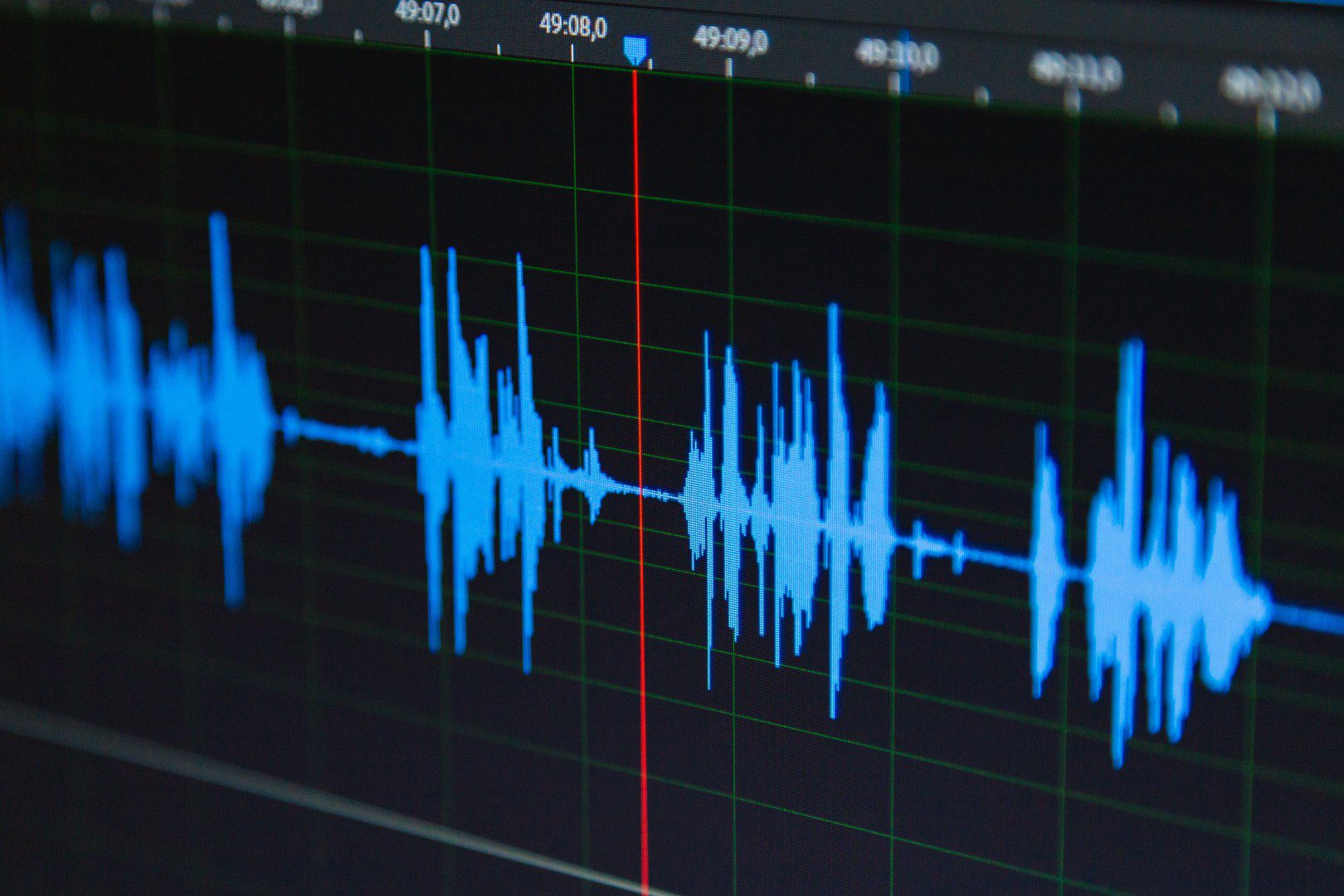

These occupations often cause hearing damage

Image: Unsplash Ringing in your ears, headache, fatigue, overstimulation, and hearing loss. Every day, about 900,000 people are exposed to loud noise at work. Despite the Working Conditions Act, hearing damage due to noise at work has been a concern for years Top 3 of the most common occupational diseases.…

Read More

What can the audio recorder do in Windows 11?

With the Windows 11 Sound Recorder app, you can quickly and easily make recordings, save them in different file formats, and share them. Do you want to record a podcast or interview in an easy way? If you have Windows 11, there's no need to look for third-party apps. Windows…

Read MoreThe US Senate votes to ban TikTok, and ByteDance has a year to sell TikTok – IT Pro – News

This is what our fathers and grandfathers said when I belonged to “Today’s Youth.” I locked myself in my room for entire days playing unintelligent products like Wolfenstein 3D, Civilization, and Leisure Suit Larry on PC. Alternating with spending hours on the couch watching cathode ray tube (aka color TV),…

Read More

Luke Humphries: World darts champion with a mental health mission

World Darts Champion Luke Humphreys advocates for mental health during the Liverpool Premier League Darts Championship, taking place at the M&S Bank Arena on Thursday 25 April. Humphries tops the rankings and with recent victories in cities such as Brighton, Nottingham and Dublin, he is one of the most prominent…

Read More

The rise and fall of billion-dollar Uber in a new series on Streamz

“Super Pumped: The Battle for Uber” is the first of a new three-part anthology, each season of which will be based on a story that shook the business world to its foundations. The first part is inspired by the best-selling book of the same name by American writer Mike Isaac,…

Read More

Greenhouse gases in balance? De Sedge as a storage place

In the De Zegge Nature Reserve in Geel, Antwerp Zoo conducts research on greenhouse gas emissions such as carbon dioxide and methane. “De Zegge is a place where a lot of living peat can still be found in the soil. The peat area is an ideal place to store carbon…

Read More

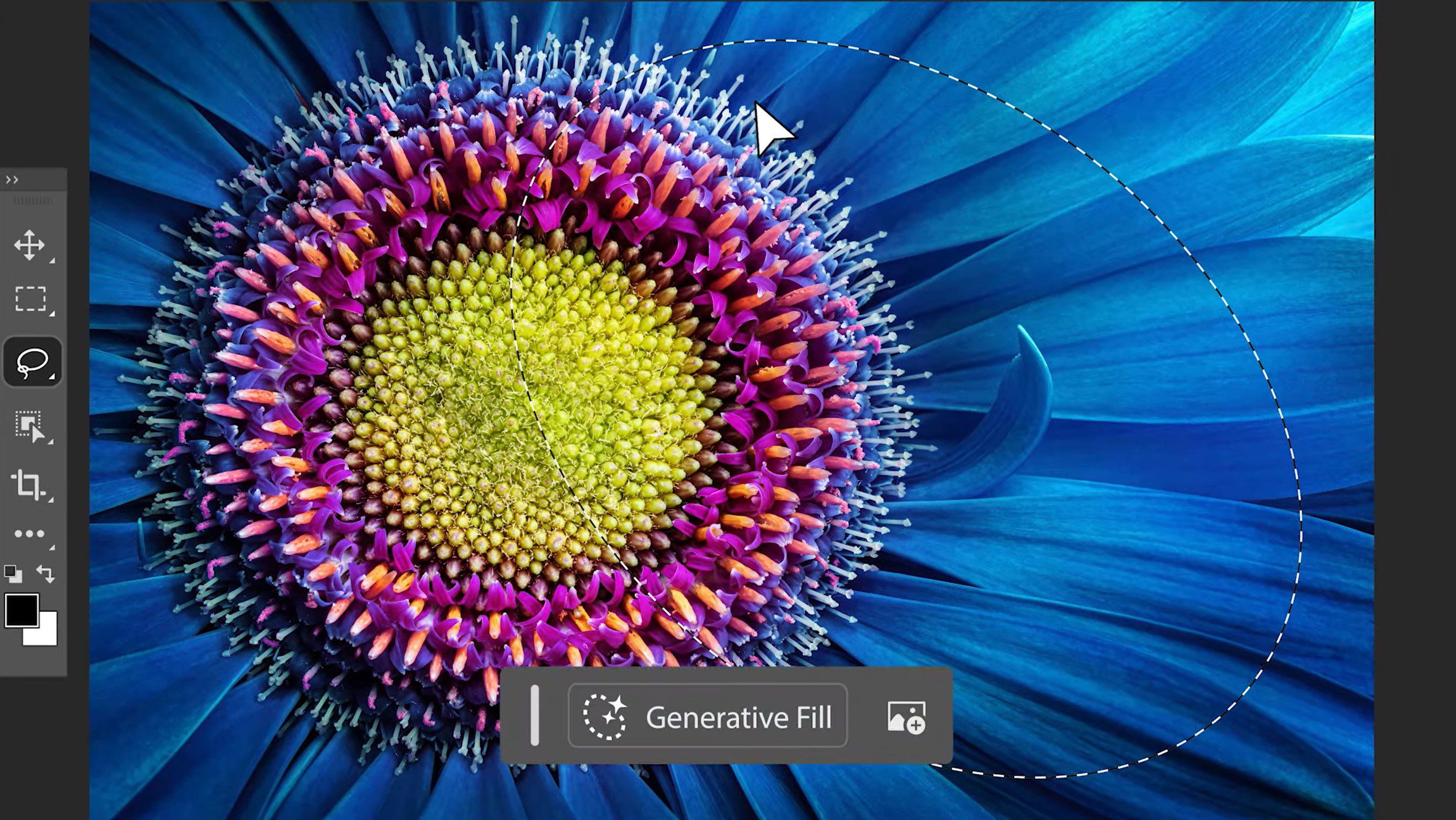

The latest beta version of Photoshop adds AI-generated images via text input

With the latest beta version of Photoshop, Adobe wants to get rid of the blank slate that everyone starts with. By entering text, you can now create a preliminary image to build on. A year after launching generative AI in Photoshop, Adobe is expanding its AI tools in the latest…

Read More

Cute dog bites woman's face and eats it: 'It ruined my life'

45-year-old Kelly from Swansea (Wales) was bitten by a friend's dog. I cut off a piece of her face and then ate it. The attack came as a surprise because the dog was a mild-mannered dachshund. “The dog was very gentle and showed no signs of being an aggressive dog…

Read More

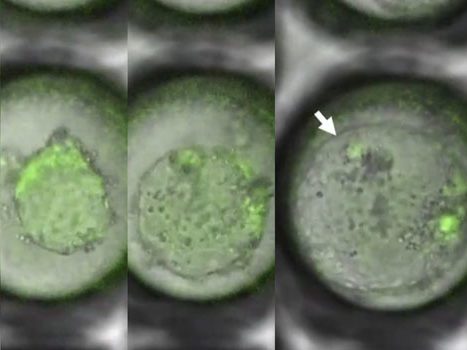

Are artificial twin embryos 'the Netherlands' next embryo model'?

Artificial twin embryos have been developed from skin cells by a research team in Maastricht. They want to investigate the development of identical twins with a shared placenta, which increases the risk of pregnancy complications. There is currently no legislation for research with these explosives. Merlin Institute The study conducted…

Read More