In the United Kingdom, the age rating of “Mary Poppins” has risen almost sixty years after its release. The responsible British Board of Film Classification (BBFC) changed the label to “discriminatory language”. Mary Poppins It had a U status, meaning that something was unlikely to contain substances that could offend…

Read More

Kees Hanse takes an indefinite hiatus as leader of the BBB party due to unclear muscle complaints

I have been struggling with my health for six months and researching the complaints I have. still searching. This does something for you as a person. That your muscles hurt. I've been dealing with that for a long time. And it gets worse every year. I now realize that this…

Read More

Is your phone getting an Android update? Check out our overview

Several devices from Nokia and Samsung received the April security update this week. Have you noticed the update yourself? Tell us about it in the comments below this article.

Read More

Elections in the world's largest democracy: Can Indian Prime Minister Narendra Modi begin his third term?

The question of why elections in India are so important can be answered by the country's increasingly important place on the international stage. The country is experiencing tremendous economic growth and has the world's fifth-largest economy, which will be worth €3,400 billion in 2023. Modi promises that if re-elected, the…

Read More

Beware of over-diagnosis and over-treatment · Health and Science

Where does this news come from? KCE report How to improve endometriosis care in Belgium? (1) presents a number of recommendations that were explained in Standard Dated April 4, 2024. The report states that endometriosis is a A very complex case It is, with too Variable impact on quality of…

Read More

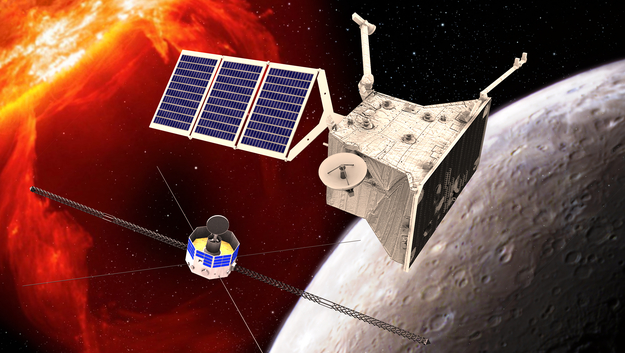

Venus loses carbon and oxygen ions

A brief visit by the European/Japanese BepiColombo space probe to Venus revealed gases being stripped from the planet's upper atmosphere. Discoveries in a previously unexplored part of Venus' magnetosphere show that carbon and oxygen ions are reaching speeds that allow them to escape the planet's gravity. (Nature astronomyApril 12). Unlike…

Read More

7 tips for flirting with self-confidence and success

What flirting does and doesn't work has been well-researched by psychologists for years. Here are 7 tips From psychologists To flirt with more confidence and success: Be clear, not precise Research shows that subtle flirtation attempts are often missed. So be more direct and clear in your flirting behavior. Use…

Read More

PROTECT YOUR SKIN: Sensually soft laundry without fabric softener, with this alternative!

Did you know that your clothes can look wonderfully soft and fresh without using fabric softener? Read on and discover alternatives to using a dose of fabric softener that will leave your laundry wonderfully soft. Use white vinegar An alternative to fabric softener is white vinegar. Vinegar neutralizes unpleasant odors,…

Read More

Exclusion of the “Animals and Transparency” organization from the elections: “Shame”

DierAnimal also cannot participate in elections. “It is a sad day for us,” says party leader Constance Adonis. “We did not get a signature from any retired Dutch-speaking MP. We could not reach 500 signatures. No list succeeded.” Bugs In the digital system According to her, there are several things…

Read More

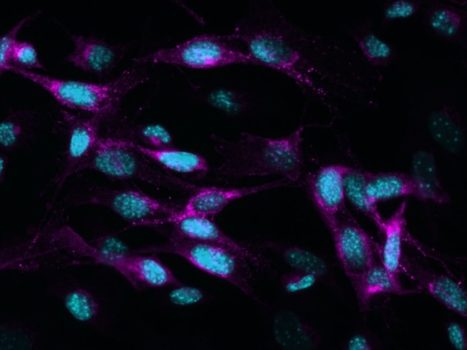

Positive outlook on negative outcomes

Positive achievements and outcomes are emphasized, while negative outcomes often remain unrevealed. It is time to deal with failures differently, and not hide them behind closed laboratory doors. Failures teach us as much as successes. They provide insights into what's not working and why. As honest scientists, we should not…

Read More