RSC Anderlecht currently tops the Jupiler Pro League. But things could also have gone very differently. This is evident from the table of expected points based on the goals that should have been scored. RSC Anderlecht currently has a goal difference of +28 through 33 matches. This is greatly beyond…

Read More

Architects cheer in the run-up to the election

Kortrijk – From better permit policy to more consumer protection: Belgian architectural organizations are calling for a joint action plan to take more decisive measures to make the spatial development and existing building portfolio more sustainable at a rapid pace. “The urgency of climate goals requires us to act united,”…

Read More

C9 meets again on the role of women in the church

The pope and the nine-member College of Cardinals invited female experts, including an Anglican bishop, to give presentations on the role of women in the church. The council was held on April 15 and 16 at Domus Sanctae Marthae, the pope's residence. On the first day, the sister participated regina…

Read More

The world-famous Arabica coffee variety is over 600,000 years old (and has therefore been around much longer than modern humans)

To decipher the reference genome, scientists used the most advanced data science and DNA sequencing technology, which can map genomes. They applied it to the genomes of 39 human-cultivated Arabica varieties. Also the genome copy of Arabic coffee Which was used by the Swedish scientist Carl Linnaeus in the 18th…

Read More

A recipe you've probably never made before: a very authentic rice dish

A dish loved by residents and tourists alike. In this article, we share with you a simple and authentic recipe for bibimbap using which you can prepare this delicious food at home. ingredients: – 300 grams of rice – 200 grams of beef (optional) – 2 garlic cloves – 2…

Read More

Women receive less medical referral than men: '

In the case of physical complaints, men can more easily rely on referral to hospital or a specialist, Ballering's doctoral research shows. One reason for this may be due to knowledge and research into hormones. “Fortunately, more research is now being done on hormones in women's and men's bodies and…

Read More

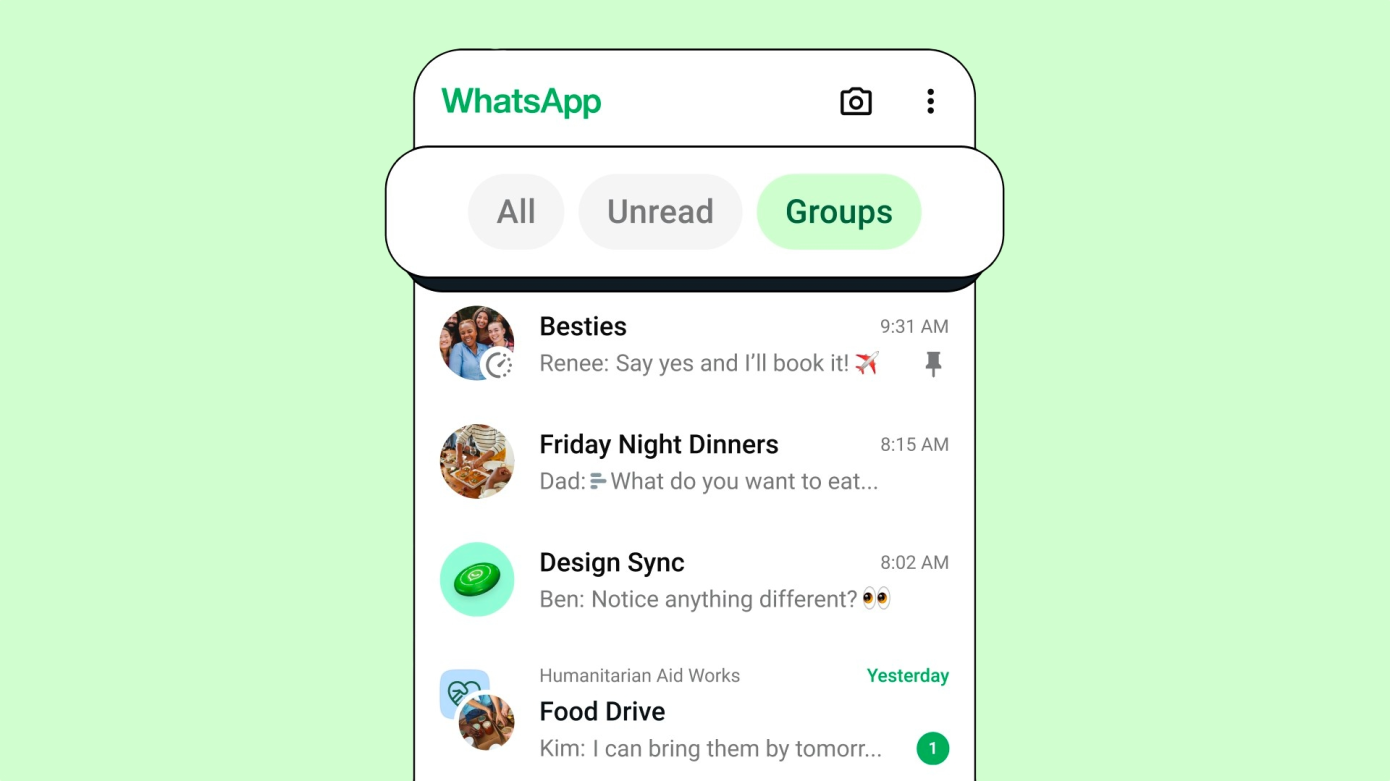

Find your messages faster thanks to the new WhatsApp filter

WhatsApp's new chat filter makes it easier for users to find chat messages. WhatsApp is adding a new chat filter to its app so users can find messages quickly and easily. The new chat filter ensures you don't have to scroll through your entire inbox to find a message and…

Read More

The Vatican says the French judge violates religious freedom

The Vatican Secretariat of State sent a letter to the French Embassy to the Holy See, describing the intervention of a French civil court in an internal church matter as a “serious violation” of religious freedom. Moreover, the court's ruling would jeopardize the immunity of Cardinal Curie. Earlier this month,…

Read More

What is it and what is it good for?

Runners often try everything to improve their training. For example, a patellar strap is sometimes used to treat knee complaints. But when do you use this? And what is it good for? We asked sports physical therapist Ronald Derksen. What is the patellar ligament? The patellar band is a belt…

Read More

Police arrested the perpetrators of a forest fire on the Costa Blanca

The Marina Alta area in the province of Alicante was recently rocked by a devastating forest fire that broke out near Tarbena. This natural disaster not only destroyed a large area of nature, but also led to the arrest of two people who may be responsible for causing this disaster.…

Read More