Positive achievements and outcomes are emphasized, while negative outcomes often remain unrevealed. It is time to deal with failures differently, and not hide them behind closed laboratory doors. Failures teach us as much as successes. They provide insights into what's not working and why. As honest scientists, we should not…

Read More

Morocco with ten sports to Paris

The Summer Olympics will be held in Paris from July 26 to August 11. Morocco is represented in ten sports, both at the individual and team levels. Moroccan athletes have qualified for athletics, rowing, boxing, Break dance, CyclingFootball (U23), taekwondo, archery, equestrian sports and kayaking. Fatima Al-Zahraa participates in taekwondo,…

Read More

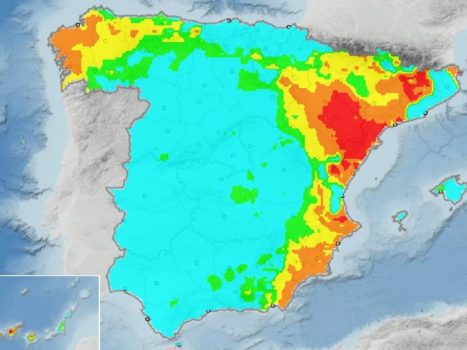

The Spanish Meteorological Service warned of the danger of forest fires in several areas

The Spanish Meteorological Service warned residents of the increasing risk of forest fires in several areas of the country. After several weeks of heavy rain, the weather in Spain has stabilized, with high atmospheric pressure and significantly higher temperatures for this time of year. These conditions greatly increase the risk…

Read More

Investing in a good organizational climate pays off

VIZKES/Shutterstock The vast majority of clinicians participating in the LAD Healthy and Safe Work project assess the organizational climate regarding psychosocial workload in their organization as inadequate. While an appropriate organizational climate is the basis for healthy and safe work. The LAD regulates the preconditions for a healthy and safe…

Read More

More than 3,000 participants at the Special Olympics National Games in Breda and Tilburg | Breda today

via: Haneke Marselis Wednesday, March 6, 2:00 p.m general Breda – With less than 100 days remaining until the start of the Special Olympics National Games, the cities of Breda and Tilburg are ready to welcome more than 3,000 athletes and coaches participating in 20 different sports. On Tuesday,…

Read More

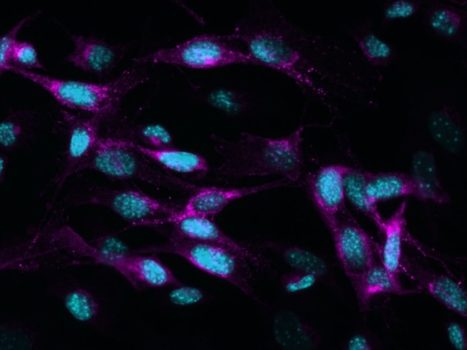

Bonobos and chimpanzees recognize their old companions in the photos

Chimpanzees and bonobos recognize old acquaintances, even if they haven't seen them in decades. This is clear from research conducted by Johns Hopkins University (USA).. Scientists showed two pictures of animals in zoos in Japan, Scotland and Belgium. One of the pictures was of a monkey that used to live…

Read More

Football is (not) a science of XG and XP: Union should have already had 7 out of 9 in the qualifiers and Anderlecht already have twenty points too many – Football News

RSC Anderlecht currently tops the Jupiler Pro League. But things could also have gone very differently. This is evident from the table of expected points based on the goals that should have been scored. RSC Anderlecht currently has a goal difference of +28 through 33 matches. This is greatly beyond…

Read More

Architects cheer in the run-up to the election

Kortrijk – From better permit policy to more consumer protection: Belgian architectural organizations are calling for a joint action plan to take more decisive measures to make the spatial development and existing building portfolio more sustainable at a rapid pace. “The urgency of climate goals requires us to act united,”…

Read More

C9 meets again on the role of women in the church

The pope and the nine-member College of Cardinals invited female experts, including an Anglican bishop, to give presentations on the role of women in the church. The council was held on April 15 and 16 at Domus Sanctae Marthae, the pope's residence. On the first day, the sister participated regina…

Read More

The world-famous Arabica coffee variety is over 600,000 years old (and has therefore been around much longer than modern humans)

To decipher the reference genome, scientists used the most advanced data science and DNA sequencing technology, which can map genomes. They applied it to the genomes of 39 human-cultivated Arabica varieties. Also the genome copy of Arabic coffee Which was used by the Swedish scientist Carl Linnaeus in the 18th…

Read More