Spotify is planning to raise prices and offer a more expensive Music Pro subscription. But what do you actually get in return? Read more after the announcement. Spotify Music Pro subscription is coming (and it's better) According to rumours, Spotify has a new subscription ready. Spotify Music Pro gets some…

Read MoreSURF achieves 800 Gbit/s data speed with network connection between Amsterdam and CERN – Computer – News

SURF has successfully conducted a network test over the 1,648 km fiber-optic connection between CERN in Geneva and Nikhef in Amsterdam. A data speed of 800 Gbit/s was achieved. SURF says the connection is suitable for future data flows. SURF conducted the successful test in collaboration with Nokia It was…

Read More

Smart snacking? Low-calorie snacks you can eat

Image: Unsplash Maintaining a healthy and varied diet is not always easy. Especially if you're trying to eat healthy and feel like eating a snack or a sweet snack. But you can consume these seven products without any worries. They are healthy and contain few calories Stay fit, eat and…

Read More

Hot Joy's new single – “Head Out Of The Window”

© Chris Power Hot Joy is really a typical American band popular with “angry little kids”. The collection was released in 2024 with “Fingers on either side“and “Folded Tongue” have already released two singles that could undoubtedly do well on American college radio stations. Of course, the important thing remains…

Read More

Several April temperature records have been broken in Spain

The extraordinary heatwaves that have hit Spain so far in April have shattered several temperature records, even in locations with more than a century of meteorological data. The northern part of mainland Spain was particularly vulnerable to this extreme heat, with several provinces setting new record highs for April, for…

Read More

Why does music make you emotional?

The songs, melodies, or tones that give a person goosebumps vary from person to person. Everyone has their own experiences with music and their own personality. Context and culture also play a role. For example, in Eastern countries, music often has different tones and rhythms than in Western countries. From…

Read More

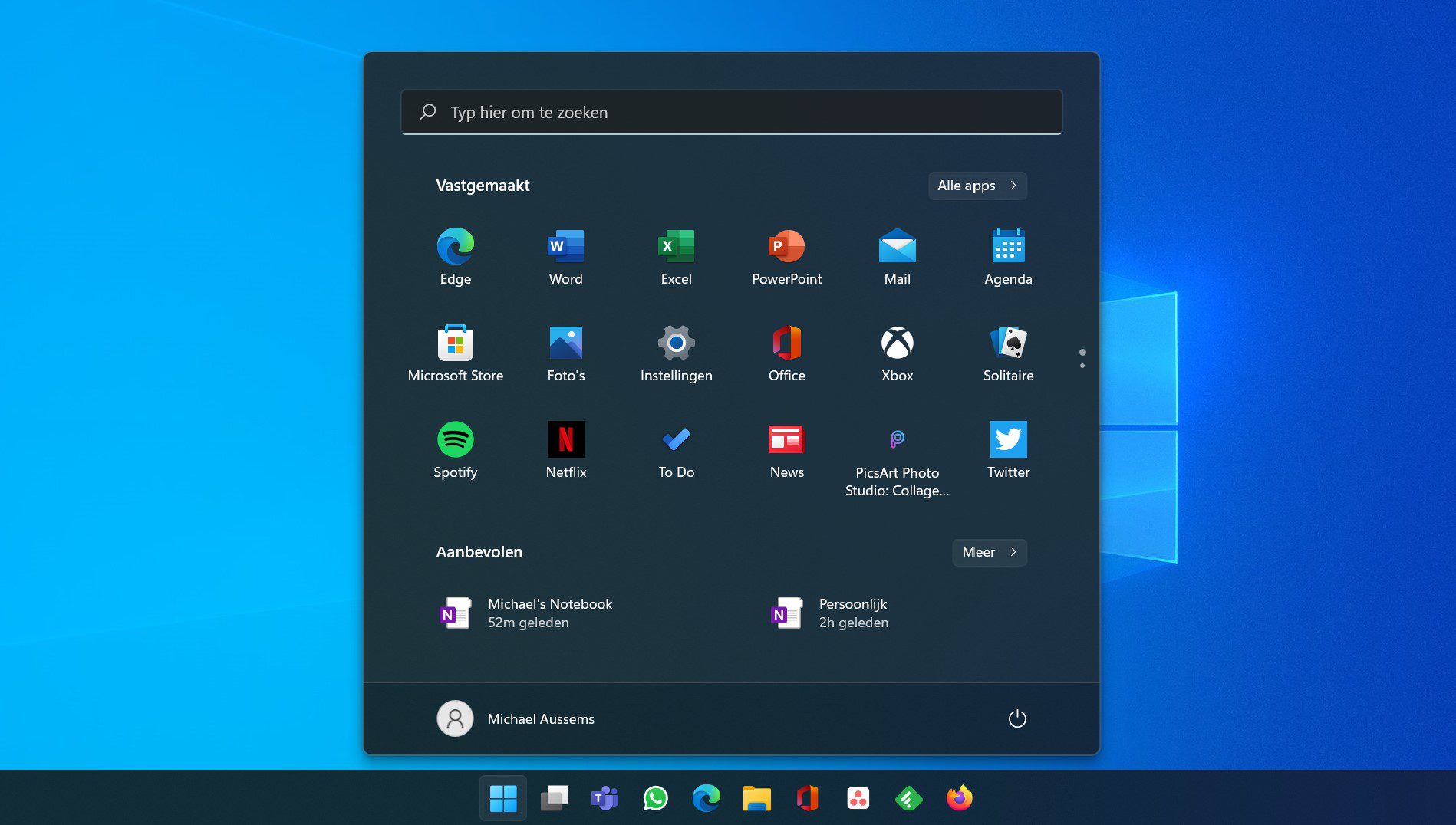

Microsoft is experimenting with unwanted ads in the Start menu.

Microsoft is putting ads in the Start menu for Windows 11 beta testers. Although there's no guarantee that Redmond will roll out the feature widely, Microsoft continues to look for ways to put more unwanted ads in front of users. Microsoft is investigating whether it can drop ads in Windows…

Read More

'Blind dating' on YouTube leads to police investigation in Morocco

Moroccan police have launched an investigation into a YouTube series in which a young woman chooses her ideal partner based on her clothes. The series, titled “Blind Dating By Outfit,” has been widely criticized for its “alleged violation of Moroccan values.” The series is an imitation of the American show…

Read More

Maintaining employee health and motivation

Sustainable employability of employees is a topic that is becoming increasingly important. In this article, you can read why and discover how you can keep employees motivated and engaged in your organization. Aging populations and workloads increase the importance of sustainable employability Last year, RIVM and TNO published a study…

Read More

The iPhone 16 camera solves this annoying problem

The next iPhone will get some great improvements. In any case, the iPhone 16 camera solves an annoying problem.

Read More