Do you love the smoky flavor of barbecue in sauces, cheeses or traditional smoked Dutch sausages? So this is a quiet day for you. The European Food Safety Committee decided today to ban smoke flavorings that give the distinctive taste. Spices are said to be unhealthy. But what makes it…

Read More

South Korea wants to ban the use of iPhones in the military due to security concerns

The South Korean military wants to ban the use of iPhones in military buildings. According to military sources, this decision was taken based on suspicions of security leaks. For example, there are concerns that confidential information could be recorded. South Korean soldiers may soon have to replace their iPhones with…

Read More

Ozempic slimming injection only works if you take smaller amounts · Health and Science

Where does this news come from? In September, gastrointestinal and obesity surgeon Yves van Nieuwenhove will publish a book on obesity (Why our fat is not the enemy). This was the reason for an interview on the Knack website (1). In that interview, he discussed in detail the slimming injection…

Read More

WhatsApp is also bringing passkeys to iOS

After a few months on Android, WhatsApp has rolled out passkeys for iOS. Passkeys provide a more secure login method to log in. After a short testing phase, WhatsApp rolled out passkeys to Android users in October 2023. Six months later, it was finally iOS's turn. WhatsApp confirms this with…

Read More

An official ceremony for Crown Prince Moulay El Hassan (photos)

April 24, 2024 – 1:00 pm – Morocco © Crown Prince Moulay El Hassan chaired, on Monday, the opening of the 16th session of the Moroccan Agricultural Exhibition (SIAM). From April 22 to 28, Meknes will witness 70 participating countries, 1,500 exhibitors and many eminent personalities, under the slogan “Climate…

Read More

WhatsApp is getting an update that makes the app more useful and secure

WhatsApp is rolling out an update on iPhone that adds support for passkeys. This should be much easier and safer for users. Article continues after ad With passkey support, you can log in to apps using biometric data such as a face scan or fingerprint. The big advantage is that…

Read More

These occupations often cause hearing damage

Image: Unsplash Ringing in your ears, headache, fatigue, overstimulation, and hearing loss. Every day, about 900,000 people are exposed to loud noise at work. Despite the Working Conditions Act, hearing damage due to noise at work has been a concern for years Top 3 of the most common occupational diseases.…

Read More

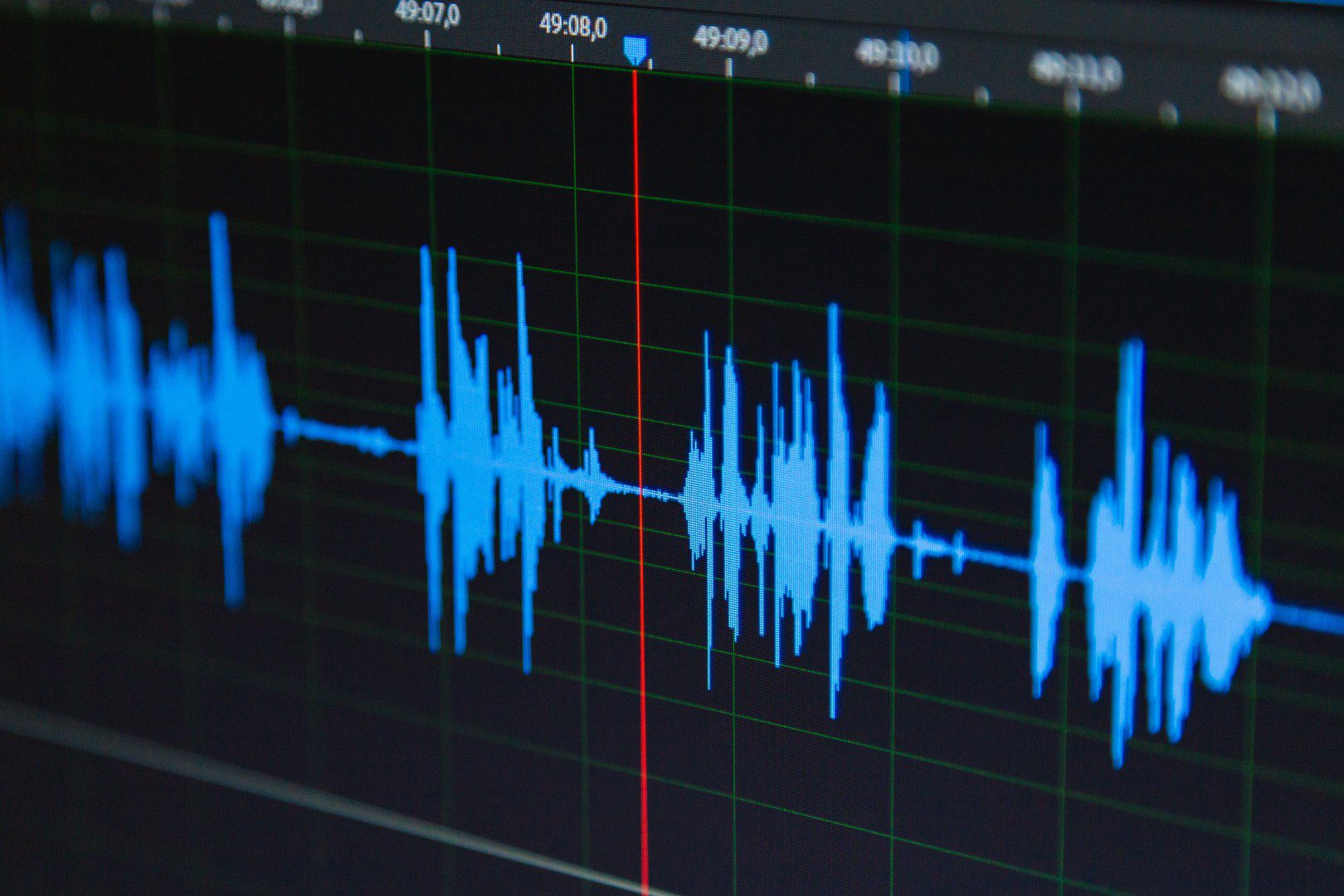

What can the audio recorder do in Windows 11?

With the Windows 11 Sound Recorder app, you can quickly and easily make recordings, save them in different file formats, and share them. Do you want to record a podcast or interview in an easy way? If you have Windows 11, there's no need to look for third-party apps. Windows…

Read MoreThe US Senate votes to ban TikTok, and ByteDance has a year to sell TikTok – IT Pro – News

This is what our fathers and grandfathers said when I belonged to “Today’s Youth.” I locked myself in my room for entire days playing unintelligent products like Wolfenstein 3D, Civilization, and Leisure Suit Larry on PC. Alternating with spending hours on the couch watching cathode ray tube (aka color TV),…

Read More

Luke Humphries: World darts champion with a mental health mission

World Darts Champion Luke Humphreys advocates for mental health during the Liverpool Premier League Darts Championship, taking place at the M&S Bank Arena on Thursday 25 April. Humphries tops the rankings and with recent victories in cities such as Brighton, Nottingham and Dublin, he is one of the most prominent…

Read More