In the De Zegge Nature Reserve in Geel, Antwerp Zoo conducts research on greenhouse gas emissions such as carbon dioxide and methane. “De Zegge is a place where a lot of living peat can still be found in the soil. The peat area is an ideal place to store carbon…

Read More

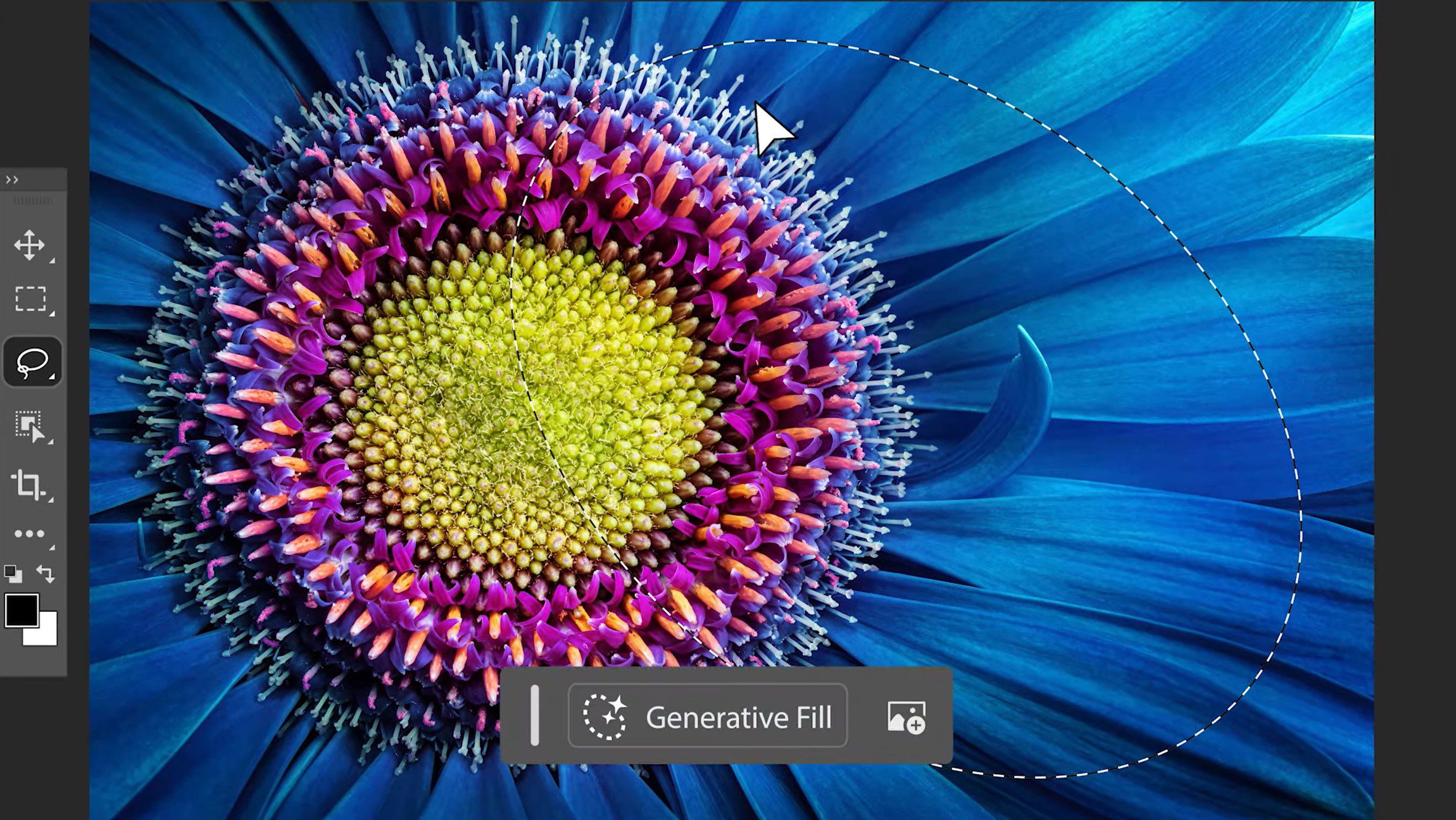

The latest beta version of Photoshop adds AI-generated images via text input

With the latest beta version of Photoshop, Adobe wants to get rid of the blank slate that everyone starts with. By entering text, you can now create a preliminary image to build on. A year after launching generative AI in Photoshop, Adobe is expanding its AI tools in the latest…

Read More

Cute dog bites woman's face and eats it: 'It ruined my life'

45-year-old Kelly from Swansea (Wales) was bitten by a friend's dog. I cut off a piece of her face and then ate it. The attack came as a surprise because the dog was a mild-mannered dachshund. “The dog was very gentle and showed no signs of being an aggressive dog…

Read More

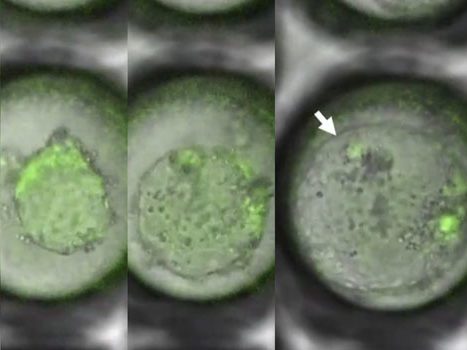

Are artificial twin embryos 'the Netherlands' next embryo model'?

Artificial twin embryos have been developed from skin cells by a research team in Maastricht. They want to investigate the development of identical twins with a shared placenta, which increases the risk of pregnancy complications. There is currently no legislation for research with these explosives. Merlin Institute The study conducted…

Read More

Apple will hold a new event on May 7 focusing on the iPad

New iPad models with OLED display? Other surprises? The Apple Pencil is already an invitation staple. After the first event in 2024 with the launch of Vision Pro, the time will come again on May 7 with the launch of new products. The centerpiece of the invitation is the Apple…

Read More

Indian Prime Minister Modi accused of hate speech after statements in which he described Muslims as “invaders”

In a country of 1.4 billion people, about 80% consider themselves Hindu. About 14% of them are Muslim, but this is still a group of more than 200 million people. This makes India the third largest Muslim community in the world. India has long been known as a country where…

Read More

The more diverse nature is, the better for your mental health

“The richer the biodiversity, the longer the beneficial effect for people lasts,” the study published in the journal Nature concluded. Walking or exercising in an environment with many different plants, trees and views is good for the mind up to eight hours longer than a trip to less diverse nature.…

Read More

Meta's Ray-Ban smart glasses now work with Apple Music

Spring is here again, so you might be ready for new sunglasses. Have you ever thought about the Ray-Ban smart sunglasses released in collaboration with Meta? If you're someone who always wants to post everything on Instagram or Facebook, Meta's Ray-Ban smart sunglasses might be for you. And if you're…

Read More

Always win with Mario Kart? Science has a way

For many players, Mario Kart is not a very serious game. But what if you really want to win? Then there are some choices you have to make and science can help you with that. When playing Mario Kart with friends, most people will simply choose the character they like…

Read More

What are Europeans' favorite sports?

According to a survey conducted by Eurobarometer, 38% of Europeans exercise weekly, and 6% of respondents say they do so five times a week or more. While some sports are essential, others are specific to certain European countries. All of Europe invites you to see its preferences in sports. According…

Read More