Written by Michael Newold··Modified:

From right to left

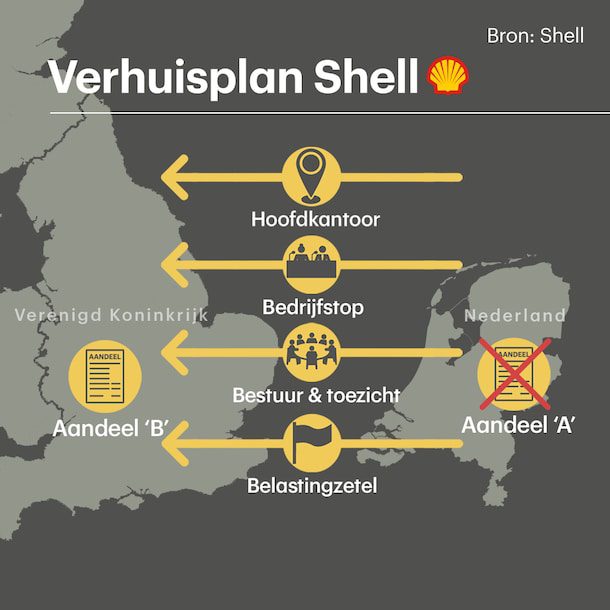

One of the largest, most famous and oldest companies in our country wants to leave. Oil giant Shell will move to London, if it has its way. Why does the company want this and what does this move mean for employees, Netherlands BV and consumers? Seven questions and answers.

1. Why would Shell do this?

The company itself cites simplifying its corporate structure as the reason. The most important change is that Royal Dutch Shell A’s stake will disappear, leaving only RDS B remaining.

This makes it easier for investors and the company itself. Because if Shell wanted to issue additional shares to make the takeover, it would now have to ask permission from two sets of shareholders. One company with one type of stock is much easier.

Buying stock, which is what companies do to please their shareholders, also becomes much easier with a class of stock. Now it gets complicated: when you buy one stock, the dividend tax is due, but not the other. Shell has wanted to get rid of this for years.

This is now even more important for achieving the transition to a sustainable energy company, says Marjan van Loon, Director of Shell Netherlands.

2. It seems logical, but why choose London?

Shell goes to the UK. The company is actually British in terms of its corporate form, but its head office is still officially in The Hague, and Shell also has a registered office in the Netherlands for tax affairs.

This will change if this plan goes ahead, as Shell will be subject to the British tax system. Jan van de Streck understands this choice. He is a professor of taxation at the University of Amsterdam. According to him, the company has lost a number of tax advantages it enjoyed in the Netherlands in recent years.

This includes eliminating the possibility of deducting losses of a foreign subsidiary from profits in the Netherlands. In addition, the abolition of the dividend tax, which Shell and Unilever have been lobbying for for years, has not been implemented.

Brexit also played a role, says Rem Kortweg of the Clingendael Institute. “Just like Unilever, Shell has always had one foot in the Netherlands and the other in London. This division over the North Sea will become even greater because of Brexit.”

He explains that tracking the differences between the rules in the EU and the UK costs multinational companies a lot of money. According to him, Shell chose the UK because the company has better access to investors through the City of London compared to Amsterdam Zuidas.

“The division over the North Sea will become even greater because of Brexit.”

But Kortwig goes further in viewing the departure of Shell and the former Unilever company as a win for the Brexit camp. There are also a lot of companies that have moved their headquarters from the UK to Europe. “They are making practical choices based on division.”

3. Does this mean anything for Shell’s sustainability ambitions?

Mark van Baal is very positive about this. Through Follow This, as an active contributor, he has been trying for years to force Shell to become more sustainable more quickly. The fact that he can now fulfill this role during British shareholder meetings makes him optimistic.

In the Anglo-Saxon business model, shareholders have more power than in a Rhineland-Boulder model like ours. Here, the top of the company can more easily ignore shareholders’ wishes by hiding behind other stakeholders such as employees.

In the US and UK, Shell is unlikely to get away with this. This also applies to greening-related decisions taken at a shareholders’ meeting, according to van Baal.

4. What does this mean for jobs in the Netherlands?

According to Shell, very little. With the exception of CEO Ben van Beurden, CFO Jessica Uhl and some senior managers, no other jobs will disappear in the Netherlands. However, upset Minister Steve Blok said on Twitter that the Cabinet had been “unpleasantly surprised”.

Not all cookies are accepted. To view this content you must haveTo adjust.

The outgoing government is so disappointed with the transfer plan that Blok and State Minister Hans Vegelbrief are asking the House of Representatives whether there is support for a profits tax. It has yet to be cancelled.

5. What do you notice about this when you pump?

Maybe nothing at all, because the company continues to operate in the Netherlands. Fuel prices are not affected by where the head office is located.

And don’t worry: The company’s pumped oil is still suitable as fuel for left-hand-drive cars.

6. Will the predicate “Royal” disappear?

Yes, that will end after more than 130 years. Shell assumes that it will lose its right to obtain the “Royal” designation and therefore continue to operate as a public joint-stock company affiliated with Shell. This refers to a public limited company which is the British version of the Dutch public limited company.

7. When will all this happen?

Shell expects to implement the plan early next year. First, shareholders must give their blessing at the general shareholders’ meeting scheduled to be held on December 10 at Ahoy Rotterdam.