The Netherlands is doing well as a fintech country. Since 2019, the financial technology sector in our country has grown the most with 226 new companies for a total of 861. Amsterdam is particularly popular; At least 40% of fintech companies are located in the capital. This and more is evidenced by EY’s 2023 Dutch FinTech Census Report.

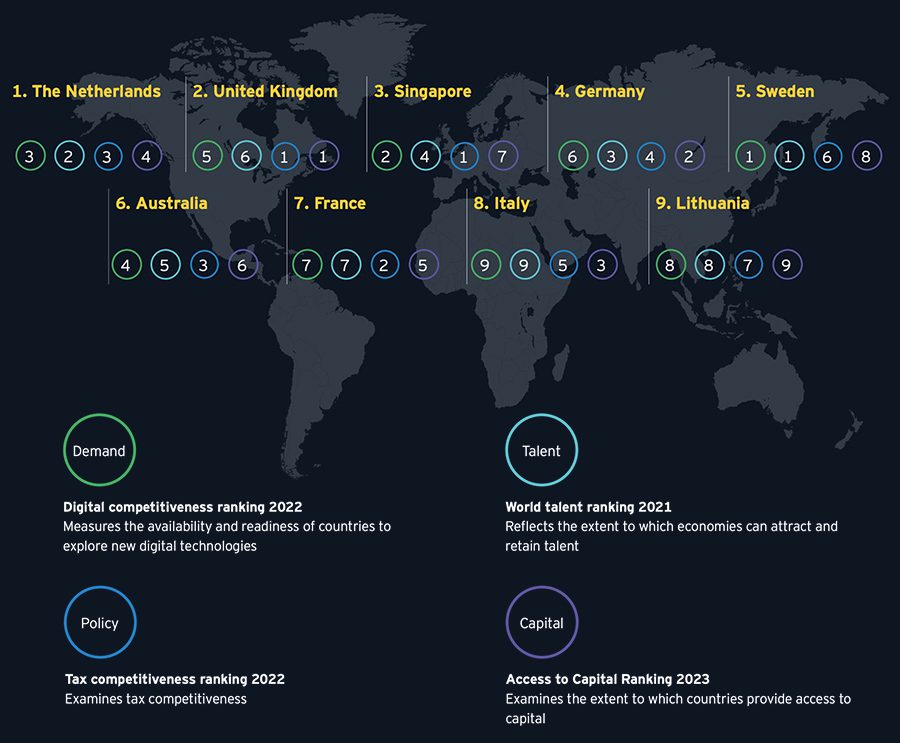

In the study, EY correlates the attractiveness of a country of residence to four criteria: Demand (demand for fintech services), talent (attracting and retaining the right employees), policy (government support targeting fintech companies) and capital (the ability to attract capital). To discover how the Netherlands compares to other countries, France, Lithuania, Germany, Sweden, the United Kingdom, Italy, Singapore and Australia were also examined.

Remarkably, the Netherlands doesn’t really excel in any of these areas. For example, the Netherlands took second place once (talent), third place twice (demand and politics) and fourth place (capital). The UK, for example, comes out on top twice (politics and capital) – but on the other hand it also has a “moderate” fifth and sixth place for demand and talent criteria respectively.

So the question can be asked: what makes the Netherlands so attractive to fintech companies? A question that EY researchers clearly have an answer to: digital infrastructure, English language skills and a pleasant living and working climate, among other things, are important differentiating factors.

Recommendations

However, the Netherlands also faces a number of challenges. Attracting and retaining qualified and suitable talent, the general economic climate and current geopolitical developments are among the most important problems. According to EY researchers, Dutch policymakers must work to remain attractive (or become more attractive) to fintech firms.

To help policymakers do this, the EY put thirteen recommendations on paper, divided into three themes: “ambition and strategy” (policy to stimulate growth and development), “the directive function” (create a directive function to encourage incentives for cooperation) and policies and regulations (protect consumers). and promoting competition within the financial technology sector).

For example, the advisory firm writes that policymakers would do well to put a clear fintech ambition and strategy on paper. “There is a clear plan confirming the added value of fintech in the Netherlands,” the researchers wrote. “This strengthens Dutch fintech players in their ambitions and attracts foreign investors and international financial companies.”

Creating a central body to manage all matters related to fintech is another important piece of advice. The researchers point to the UK’s Center for Finance, Innovation and Technology as an example.

To prevent unwanted mixing of public and private functions, it is important, according to EY, that roles, mandates, and partnerships are clearly laid out on paper.

know more? Complete research (including the thirteen recommendations) from EY is here to find.