Good morning, and welcome to our information on the global economy, financial markets, the eurozone and trade.

We almost did it. Today marks the final trading session of 2020, ending a year dominated by the Govt-19 epidemic.

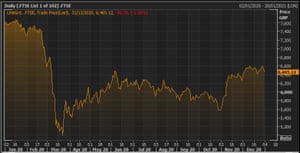

After a very turbulent year, Britain FTSE The 100 stock index is on track for its worst year since the financial crisis 12 years ago, and any poor performance on the big stock indices.

The FTSE 100 made a bad start this morning, falling more than 1% in the open (soon).

The Futsi Blue-Chip Index has fallen 14% in value this year, pushing Europe into locks as it struggled to recover from the devastating losses caused by wildfires in February and March.

This is worse than competition codes. Of Germany DAXFor example, managed a 3.5% increase in 2020.

Other international markets had a very strong year, especially in Japan and Asia Nikki 16%, and of China CSI 300 It has increased by 27% since the beginning of 2020.

The US market has also fallen S&P500 Up to 15% by 2020, and technology-heavy Nasdaq More than 40% – due to the rise in mega cap technology stocks.

Overall, the stock markets are reeling from their spring slump, thanks to unprecedented stimulus packages from governments and central banks.

The FTSE 100 Affected by many factors. It does not have large technology companies, but rather is dominated by financial institutions and energy companies, as well as some self-defense-yet-induced consumer goods manufacturers and applications.

The strength of the pound (which has reached a 31-month high against the US dollar) has also hit major exporters.

Plus the uncertainty of Brexit and the economic damage caused during this year’s epidemics have reduced demand for UK stocks, with travel, leisure and retail sales all rotting for 12 months.

Russ Mold of A.J. Bell Named 2020 ‘Game of the Two Parts’, it wrote earlier this month:

“The UK has been weighed down by a turbulent performance, its sectoral composition and high exposure to banks and oils and limited exposure to technology, as well as Brexit and perceptions (fair or unfair) that the epidemic is not being handled properly.

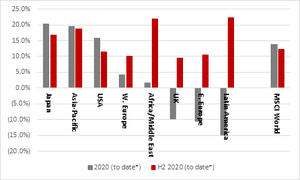

In fact the UK performed the worst in the second half of the year when Latin America, the Middle East / Africa and Asia were the best countries.

“This shift towards emerging markets refers to investors looking for cyclical growth – rather than secular growth – or more credible, almost defensive advancement – as well as the value of wanting a better phrase than global export and inflation plays.

By the end of the year we will be monitoring the process and looking forward to 2021.

Agenda

- 12.30pm GMT: London Stock Exchange closes early

- 1.30pm GMT: US Weekly Unemployment Demands